- Services

- Global Business

- CFC & PEM Rules

CFC & PEM Rules

CFC & PEM Rules

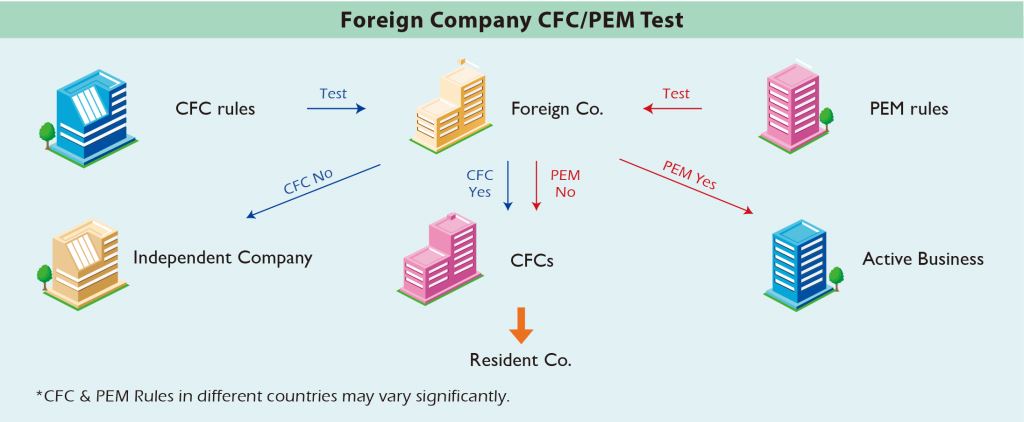

A controlled foreign company (CFC), is a company outside of its controller’s resident jurisdiction. A company will qualify as a CFC if the following criteria are met:

| 1. |

A domestic tax payer controls the company –

Not all foreign companies are CFC. In the United Sates, a foreign corporation that is more than 50% owned (directly, indirectly, or constructively) by U.S. shareholders. In UK, control is considered to exist if the shareholder owns 40% or more of voting interests. |

| 2. |

The company is located in a different jurisdiction

From the one in which its controller resides, typically a low tax or no tax jurisdiction. |

| 3. |

The CFC derives specific types of taxable income

include investment income (interest and dividends), passive income (rents and royalties), and active income (sales and services). |

Many jurisdictions have exemptions on CFC status. For example, If a foreign company meets any of the following tests will not be considered a CFC:

| • |

It is tax resident in a “white list” country that is not considered to be a tax heaven, |

| • |

The foreign company meets an active business test, |

| • |

The foreign company is publicly traded on a recognized securities exchange. |

PEM - Place of Effective Management

PEM has been defined to mean a place where key management and commercial decisions that are necessary for the conduct of the business of any entity as a whole are in substance made. An entity may have more than one place of management, but it can have only one place of effective management at any one time.

Criteria of PEM include:

| 1. |

Where the meetings of its board of directors or equivalent body are usually held, |

| 2. |

Where the chief executive officer and other senior executives usually carry on their activities, |

| 3. |

Where the senior day-to-day management of the person is carried on, |

| 4. |

Where the person’s headquarters are located, |

| 5. |

Which country’s laws govern the legal status of the person, where its accounting records are kept, |

The place of effective management rules do not apply to a company engaged in active business. A foreign company is said to be in active business if all of the following conditions are satisfied:

| 1. |

Its passive income is not more than 50% of its total income. |

| 2. |

Less than 50% of its total assets are situated in foreign jurisdiction. |

| 3. |

Less than 50% of the total number of employees are situated or are resident domestically.

|